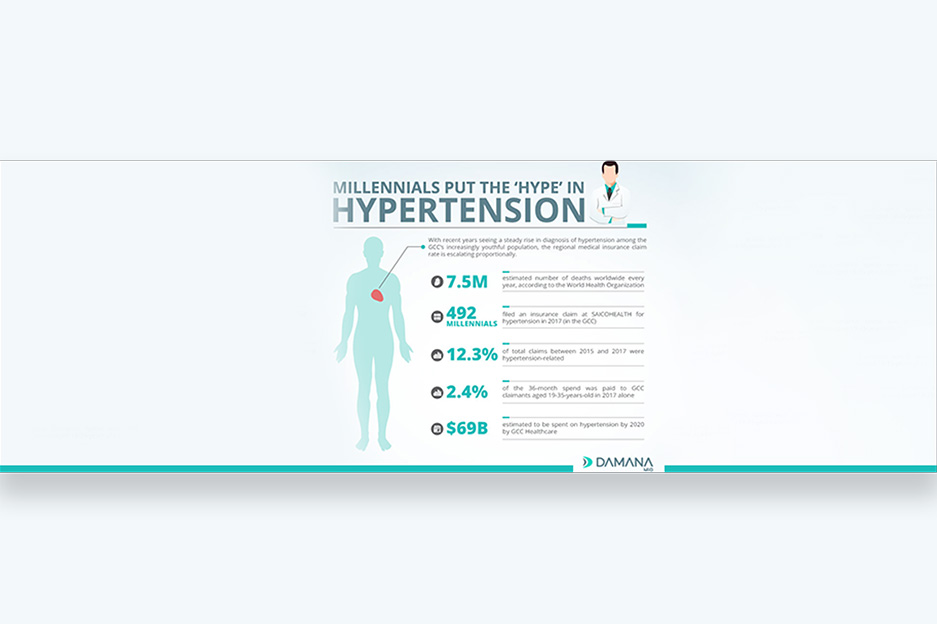

With recent years seeing a steady rise in diagnoses of hypertension among the GCC’s increasingly youthful population, the regional medical insurance claim rate is escalating proportionally: an average of over one claim per day from millennials with hypertension foreshadows significant cost implications in mandatory healthcare policies.

Estimated to cause 7.5 million deaths worldwide every year, according to the World Health Organization, hypertension is one of the world’s most prevalent silent killers. Often occurring without noticeable symptoms and no cure available once diagnosed, untreated hypertension can increase a person’s risk of potentially life-threatening circulatory system diseases, such as heart attacks and strokes.

Most commonly found in older patients, the alarming rate of hypertension diagnoses in young adults over the last few years is reflected in our most recent hypertension statistics, which show 492 millennials – more than one a day – filed an insurance claim for hypertension in 2017.

As one of the leading regional providers of customized insurance solutions, DAMANA paid out hypertension-related claims representing 12.3 per cent of total claims between 2015 and 2017 under SAICOHEALTH, DAMANA’s health insurance brand. Of this three-year total, roughly 2.4 per cent of the 36-month spend was paid to GCC claimants aged 19-35-years-old in 2017 alone. The fact hypertension in millennials now deserves its own place in our categorization of spend indicates how the trend curve is accelerating.

Two key factors are driving the prevalence of hypertension in young people: a higher dependence on processed foods with high sodium content and a growing lack of physical activity. In reality, we may be seeing the tip of the iceberg. Detection is growing, in part, due to the positive steps to address health issues being taken at national levels across the GCC. As regional states head towards mandatory healthcare adoption, increased screenings have shone the spotlight on a growing epidemic.

Indeed, the increasing diagnoses of hypertension in young adults across the GCC could have a significant impact on regional healthcare systems, namely increasing the burden of healthcare spend and driving up premiums as governments across the GCC firm up their mandatory healthcare frameworks.

While the benefits of mandatory healthcare insurance have positive impacts on the community at large, the hard costs of bearing the financial responsibilities inherent in this nationwide initiative must be considered. Costs have a tendency to trickle down to consumers.

The potential implications on collaborative efforts between insurance companies, government entities and private sector organizations to reduce risks to mandatory healthcare adoption are also important. It must be noted that the total GCC healthcare spending is estimated to reach $69 billion by 2020. Spend will rise as governments and private companies make significant investments to improve the range of medical offerings and services available, according to the 2016 Global Innovation 1000 Study from Strategy&, part of the PwC network.

When it comes to Bahrain, last year the President of the Supreme Council for Health announced that mandatory health insurance for citizens, expats and visitors – as outlined in the National Health Insurance Scheme – is to be implemented by early 2019. While, the issue of hypertension in our youth places further financial burden on Bahrain’s National Health Insurance Scheme, it is critical we examine methods for prevention as part of a holistic approach to managing health – or else increased premiums for our youth will not be the only concern.

Link: http://www.gulf-insider.com/millennials-put-hype-hypertension-prevalence-condition-poses-significant-cost-implications-future-gcc-regions-healthcare-provisions/